Cash or Credit

Description of Cash or Credit

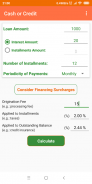

Cash or Credit is a financial application designed to assist users in calculating the real interest rates associated with credit card purchases made in installments or loans. The app is particularly useful for individuals looking to understand the overall costs of their credit card transactions, as it takes into account various surcharges that may apply, such as taxes and insurance. Users can download Cash or Credit for the Android platform, providing them with a tool to better manage their financial obligations.

The application enables users to analyze the interest rates linked to their credit card statements. By inputting relevant data from their statements, users can gain insights into the surcharges they may incur when making purchases on credit. This feature allows for a clearer understanding of how much credit purchases will cost over time, empowering users to make informed financial decisions.

Cash or Credit's functionality includes the ability to calculate the real cost of financing through credit. Users can input details such as the total amount financed, the payment period, and any associated fees. The app then calculates the effective interest rate, enabling users to compare different financing options. This can be particularly beneficial when deciding whether to use a credit card or seek alternative financing methods.

It also offers a feature for loan calculations, allowing users to determine the total repayment amount for loans they are considering. By entering the principal amount, interest rate, and loan term, users can see how much they will ultimately pay back, including any additional costs. This transparency helps users assess the affordability of loans and make choices that align with their financial capabilities.

Additionally, Cash or Credit assists users in understanding the impact of different repayment strategies. By simulating varying payment amounts and schedules, users can visualize how these changes affect the overall interest paid and the total time required to pay off their debt. This capability can help users develop personalized repayment plans that suit their budgets and financial goals.

The app is designed with user-friendliness in mind, ensuring that individuals can navigate it easily, regardless of their financial expertise. The interface is straightforward, providing clear prompts and guidance throughout the calculation processes. This accessibility encourages users to take control of their financial decisions without feeling overwhelmed.

Another aspect of Cash or Credit is its ability to track multiple accounts. Users can manage various credit cards or loans within the app, making it simple to compare costs across different forms of financing. This multi-account feature is vital for users who hold several credit cards or are exploring different loan options, as it consolidates their financial data in one place.

Cash or Credit also emphasizes the importance of awareness regarding surcharges. By breaking down how fees contribute to the overall cost of credit, the app educates users on the true expenses of borrowing. This knowledge is crucial for users who wish to minimize their financial liabilities and avoid unexpected charges.

The app's calculations are based on the latest financial data and algorithms, ensuring that results are both accurate and relevant. As users input their information, they can trust that the calculations reflect current market conditions, which is essential for making sound financial decisions.

Security is another critical component of Cash or Credit. The app incorporates measures to protect users' personal and financial information, giving them peace of mind as they utilize the tool. This focus on security reinforces the app's commitment to user trust and data protection.

For those who may need further assistance, Cash or Credit provides resources and tips within the application. These resources can guide users on financial literacy, budgeting strategies, and managing credit effectively. Such support can be invaluable for users seeking to enhance their financial knowledge and skills.

Incorporating these various features, Cash or Credit serves as a comprehensive tool for managing credit-related financial decisions. Users can calculate interest rates, compare financing options, and track multiple accounts, all while benefiting from an easy-to-use interface and educational resources.

By enabling users to take a proactive approach to their credit management, Cash or Credit helps individuals navigate the complexities of financing with greater confidence. The app fosters a better understanding of financial responsibilities, ultimately leading to more informed choices and improved financial health. As users engage with the application, they can enhance their ability to manage credit effectively and make decisions that align with their financial goals.

With its diverse features and user-friendly approach, Cash or Credit stands out as a valuable resource for anyone looking to better understand the implications of their credit card use and loan options. Downloading Cash or Credit can be a significant step toward improved financial management and awareness.